Menu

A vertically integrated

Real Estate Company

With decades of experience, Kosene & Kosene has developed some of the most prolific retail centers and residential sites in Indianapolis and built an extensive Residential and Commercial portfolio. We provide the highest level of service to maintain and build long-term relationships with our clients and tenants.

40+ Years of Experience

Investment

Achievements

Our average Internal Rate of Return on past projects is well in excess of 35%.

Investment

Achievements

Our average Internal Rate of Return on past projects is well in excess of 35%.

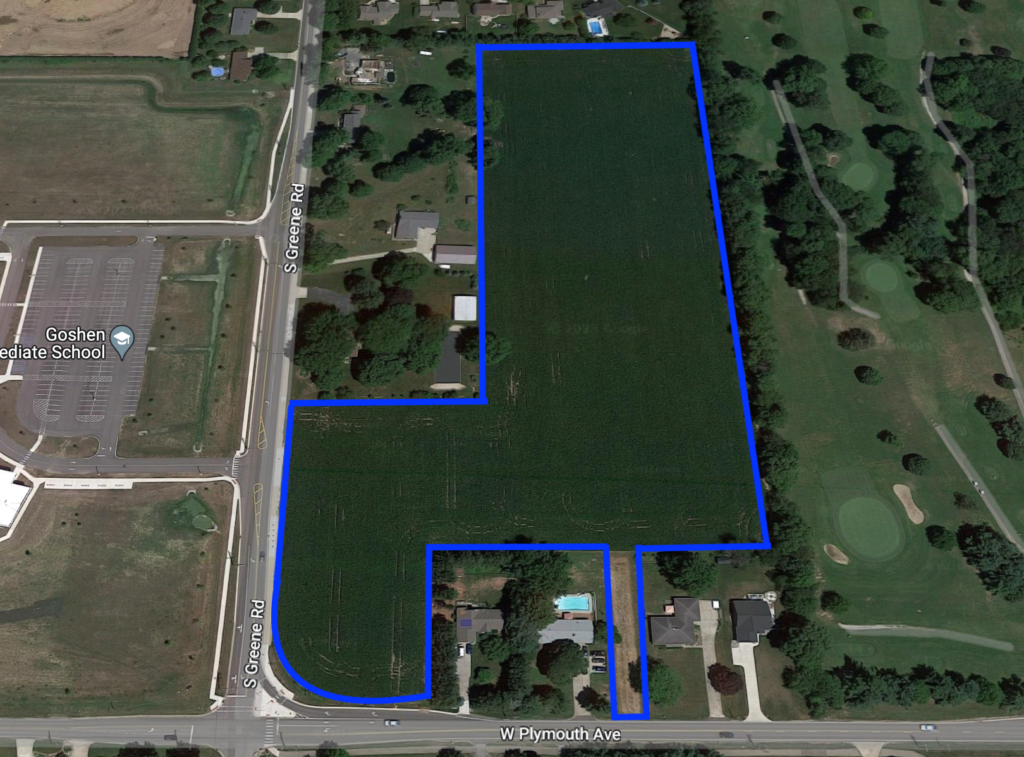

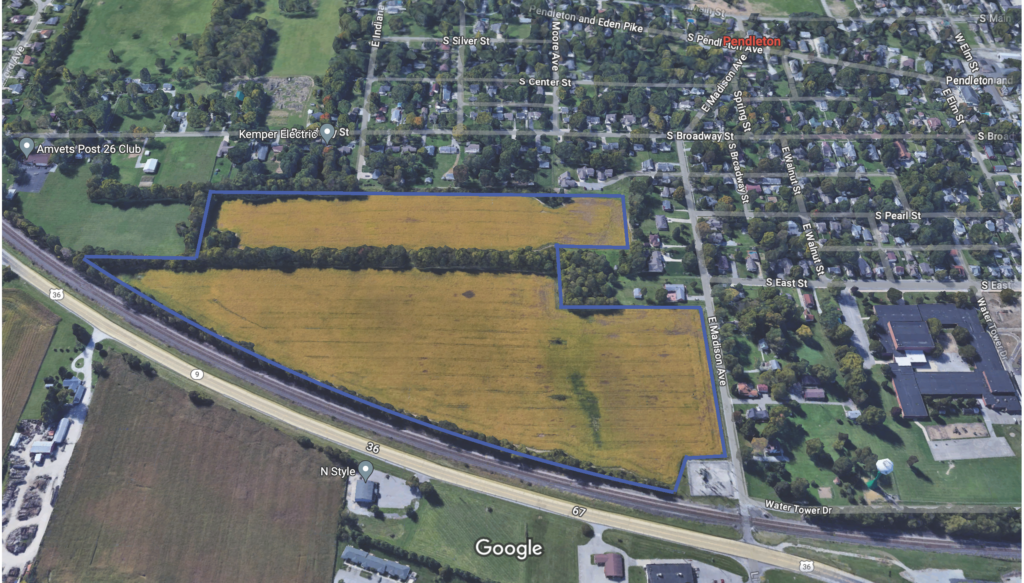

Featured Projects

Kosene & Kosene has a proven track record and a value-driven investment strategy that aims to benefit investors, tenants, communities, and partners alike.